You’ve already heard about the jobs numbers: a record 6.6M new jobless claims and -701,000 nonfarm payrolls, the latter a 3 week old lagging indicator. I won’t dwell on these because they’ve gotten so much coverage, but suffice to say they’re unprecedented.

“I never thought I’d see such a print in my lifetime as economist,” said Thomas Costerg at Pictet Wealth Management, who had the highest forecast in the Bloomberg survey, at 6.5 million.

Of course, stocks were up 2.8% on the day. Why not, eh?

I shouldn’t be facetious. We all know why stocks pumped.

This tweet is an example of news that algorithms know how to incorporate. This is news that fits into forecasting models. Orange man tweet, oil price go up.

News that doesn’t fit are 30-sigma events in the labor market. Everyone knows in the abstract that this is an incredibly bad thing, but pricing all of the implications in is nearly impossible.

Stocks didn’t react because economic data as stupefying as the jobs numbers has made a proverbial deer-in-headlights of markets. It’s hard to fathom the kind of wreckage those numbers indicate before it’s actually here.

Take, for instance, mortgages.

The headline of the article the above tweet references is Mortgage Defaults Could Pile Up at Pace That Dwarfs 2008:

Mortgage lenders are preparing for the biggest wave of delinquencies in history. If the plan to buy time works, they may avert an even worse crisis: Mass foreclosures and mortgage market mayhem.

Borrowers who lost income from the coronavirus -- already a skyrocketing number, with a record 10 million new jobless claims -- can ask to skip payments for as many as 180 days at a time on federally backed mortgages, and avoid penalties and a hit to their credit scores. But it’s not a payment holiday. Eventually, they’ll have to make it all up.

As many as 30% of Americans with home loans – about 15 million households –- could stop paying if the U.S. economy remains closed through the summer or beyond, according to an estimate by Mark Zandi, chief economist for Moody’s Analytics.

Do I know the exact mechanics of the mortgage market? No. Can I tell you the chain of failures to worry about? Absolutely not - I’m not that knowledgeable or even smart.

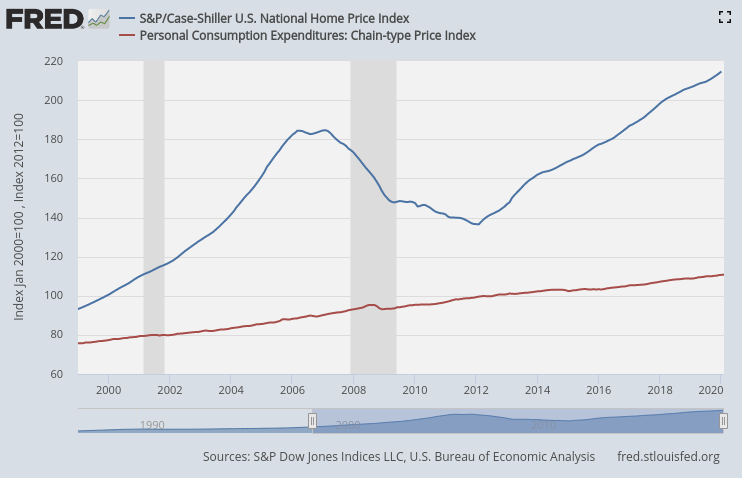

Can I tell you that we’ve been in a housing bubble fueled by asset inflation and low rates? Or that there’s a good chance there are some cracks in the mortgage infrastructure that will be stressed bigtime by a 30-sigma event?

I can’t for sure, but I’m convinced enough to bet on it.

Fiscal stimulus is coming though, right? Well, sort of. The idea isn't the implementation.

This is the government we’re talking about — an organization that spent $1.7B and 3 years to prepare HealthCare.gov, and still couldn’t launch a functioning website on the release date. An organization that repressed the release of initial coronavirus test results in Washington for weeks back in February. An organization whose center for disease control has been telling us for months that healthy people don’t need to wear masks.

My bet is that regardless of the fiscal stimulus they pass, the distribution mechanisms used to get this fiscal stimulus out are either going to be broken or laggy or both. While the economy is shut down and bills pile up on overleveraged households (recall: 12% of Americans couldn’t afford a surprise >$400 expense before 10 million of us were unemployed), the government is figuring out how it can cut paper checks in less than a few weeks.

Set aside tackling the complexities of the small-business loan market.

I know this is sort of inherent in the name of the newsletter and all, but I couldn’t possibly be more bearish without a hot war or alien invasion (or both) happening.

—

A final tidbit for you. What do you think happens when the dominant source of equities demand, the almighty share buyback, dries up for the rest of the year? What happens when big companies start cutting dividends?

Who’s going to be buying the dip?

Positioning

I’m short everything.

I’m so short that the prospect of making a small investment in 9mm ammo as a store of value is starting to sound increasingly less crazy. Still crazy. Just less crazy.

I’ve booked some gains in the last day shorting various millennial-friendly stocks (TSLA, FB, ZM). I have an open PTON short that’s losing me a little money, but I’m far from closing that.

I’m still short anywhere from 10 to 16 /MES (S&P500 futures) contracts. This is a core position that I’ll be holding through this crash.

My constellation of SPY puts is down around 11k (unrealized) but of course most of the strikes are sub-220, so no surprise there.

Everything else I own is either cash or tiny core positions in gold and BTC.

I’m not buying any gold or Bitcoin until I see another crash in equities or something causes my Weimar Republic Proximity meter to go to defcon 3.

I think over the coming weeks, cross-asset correlation is to 1, dollar scarcity is going to continue to be a thing, and we’re going to see big sell-offs in dollar denominated assets.

Congress and the fed are going to keep acting. Each action will spark little rallies that are soon beaten back by the harsh realities of transmission issues and rapidly deteriorating consumer conditions.

I’ll be looking to jump into gold/BTC pre-crash only on the condition that something outrageously inflationary happens. But even then, I think there isn’t a way around deflating first.

Recommendations

If you like this kind of stuff, I highly recommend subscribing to Real Vision and watching their daily updates. A lot of what I’m writing here is a distillation of the same points they make much more eloquently.

Also check out the latest memo from famed investor Howard Marks, Which Way Now?.

—

I write this newsletter mostly to crystallize my thoughts and catalog them for later. I could be massively wrong here. If I am, hopefully I’ll have at least provided some edutainment for posterity.

I don’t have a job at the moment - in fact in classic form I’m sitting in my mom’s basement right now. If you’ve enjoyed bearhaus so far, consider sending me a few bits in appreciation.

BTC: 1CvrSq8K2qz5f9PqfH3uyUxywiNZRjNrAQ

California's like a beautiful, wild girl on heroin; high as a kite, thinkin' she's on top of the world, not knowing she's dying even if you show her the marks.

- Rumblefish, Francis Ford Coppola’s most underrated movie

Hi James, thanks so much once again for putting out this amazing content. I have a trial version of Real Vision, and one thing that I was wondering is that Raoul Pal has said there and on Twitter that he is actively accumulating bitcoin every day. Do you mind sharing why you are more bearish than him on BTC? I would obviously love to see bearish price action, but curious whether I should start accumulating too or get rekd.