2020-03-25

Our first bounce

Good afternoon.

Enjoying the stimulus? We’re in a bounce, but I think it will be brief.

My P&L melts, but I remain short.

A quick tour of darkness on the horizon.

—

Kudlow promises that we’re going to get $6T in combined juice, between $4T from the Fed lending in new and interesting ways, and $2T of fiscal stimulus amounting to direct payouts to individuals and businesses.

Obviously this sounds like a lot, and the market responded with a ferocious bounce yesterday.

Predictably, this crushed my daily P&L. I spent the day chasing tops shorting SPX (via /MES) and stopping myself out — the aforementioned hazards of trying to scalp vol. Mercifully I pared my losses with a lucky gold short, and much of this red amounts to giving back some of the profits from the last few days of pretty successful shorting.

Much of the P&L horror shown there is unrealized and a function of options repricing.

Is this time finally different?

Luke and I have spent much time in the past 24 hours discussing whether or not this is a fundamental regime change in markets. With the Fed, and now congress, responding with unprecedented stimulus, will stocks finally become untethered to reality? Are equities morphing into their terminal state: collection of normie-friendly shitcoins, unburdened by any sort of fundamental measurement; a zoo of virtual tokens to sop up the cash pouring out of Washington for those that understand what an ACH transfer is?

The two of us joked morbidly a month ago that one likely outcome was the entire country would be locked at home, subsisting off of pasta and bottled water indefinitely, with nothing to do but turn on CNBC and bid the Dow to all-time-highs while the printing presses whirred.

The federal budget for 2019 was $4.45 trillion. With the government promising to inject a combined $6 trillion for starters, could stocks become completely detached from any kind of real valuation? This is a serious worry of ours and challenges our current approach of shorting the hell out of SPX.

Maybe we should take what cash is left of our options position, and rotate into equities and Bitcoin for the reflation trade?

While this is a possibility, I still don’t think it’s the base case. As I’ll go into shortly, fundamentals are absolutely terrible. We took Dad’s Camaro out for a spin and hydroplaned into a tree; Mnuchin may have shown up with three tons of superglue and motor oil, but that doesn’t mean we’ll be driving the car home.

I remain doubtful that monetary and fiscal policy has the precision to transmit to all the parts of the economy that need support.

I think the most real risk to our current big trade (SPY puts dated at expiry for anywhere between April and June) is that the crash takes longer to happen than anticipated. It’s conceivable that stimulus could keep markets propped up for some amount of time. But I find even this dubious: the flood of horrible news we’re going to see in the next two weeks will make our heads spin.

NYC’s medical system will continue to implode:

Industrialized demand for stocks will dry up. Equity appreciation for the past, oh, five years has been contingent on buybacks since corporates have been the dominant buyers. No longer?

Hopes about a covid19 treatment may be overhyped (which, by the way, I say without relish—needless to say I would rather go bankrupt than see this virus continue):

Both corporates and individuals have no buffer to weather this storm:

And the jobless-claims numbers coming out tomorrow are shaping up to be unprecedented:

All this tells me that we are far from the bottom, and almost any conceivable action by an essentially bumbling bureaucracy, deep though its pockets may be, can only prolong the inevitable.

I remain convinced that this is a classic bear-market bounce. If history tells us anything, it’s that these huge updrafts almost universally precede giant moves downwards.

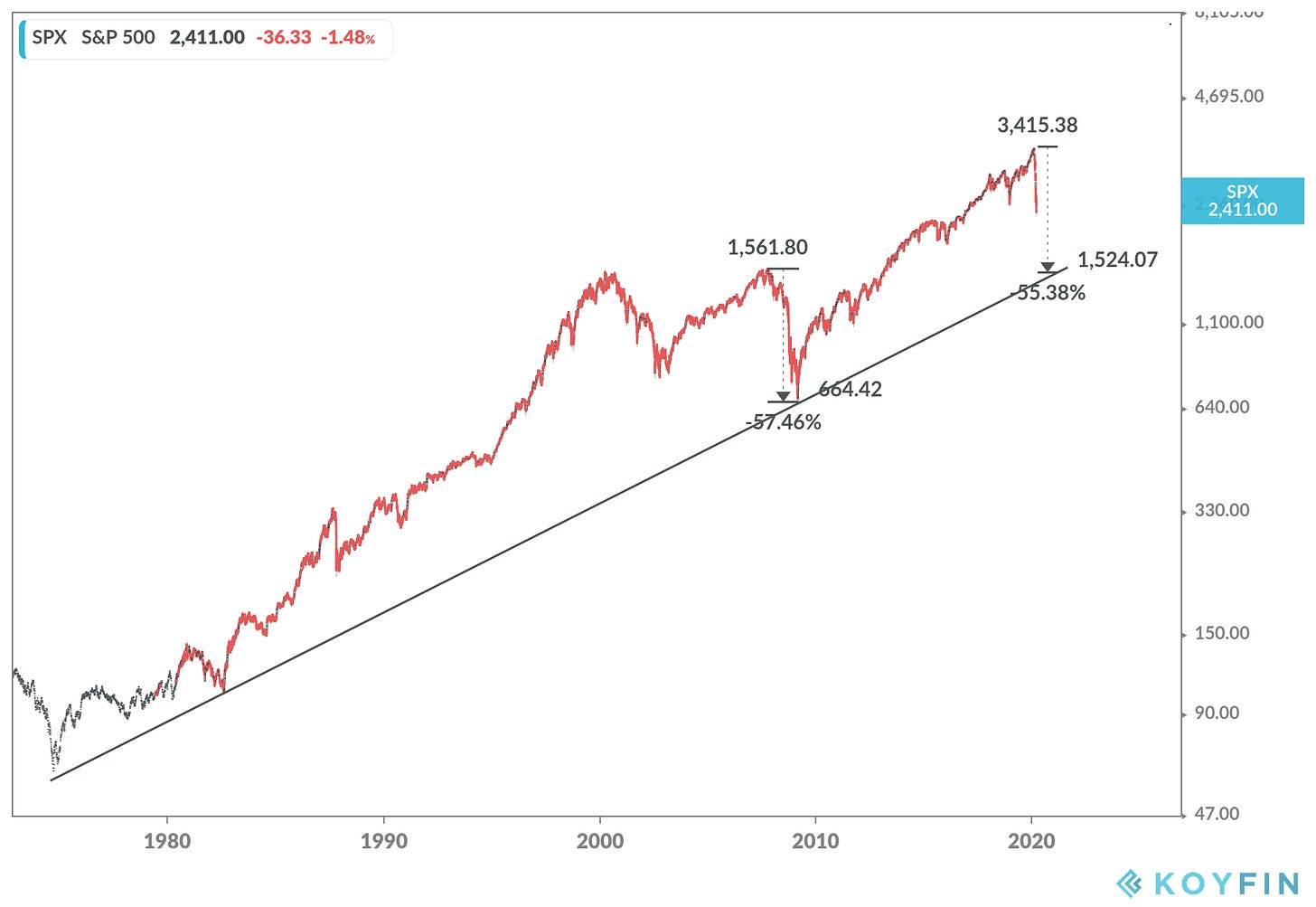

Ready for some non-advice? Stay patient, resist the urge to buy dips, and keep your eye on The One Bearhaus Chart.

A closing note about Boeing

I’d like to think that at an earlier time in American civilization, if $60B in public money was awarded to an executive team who had spent the past decade knowingly marketing a lethally defective product and spending almost all free cash flow on share buybacks, there’d be a lot of us in the streets with weapons.

We’ve gone soft, and eventually the consequences won’t be virtual.

I guess now is a decent time to mention that I made a small market buy of Bitcoin this morning.

—

Want more in your inbox? Subscribe.