2020-03-17

Fed bazooka and the wait for fiscal

Hi, good morning.

The Fed shot its shot.

I am almost religiously short everything.

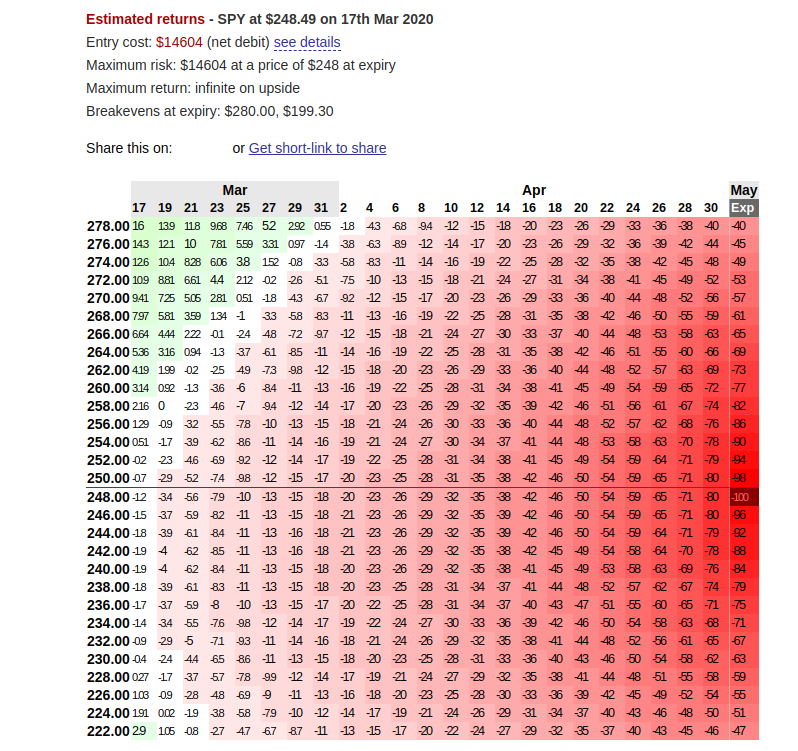

I took some profits yesterday and am not looking to buy overpriced options (thanks to high implied volatility).

Nothing in here is financial advice. This is a cataloging of my inevitable financial loss purely for entertainment.

Outlook

The Fed has done all the easing they’re going to do.

the Committee decided to lower the target range for the federal funds rate to 0 to 1/4 percent […]

over coming months the Committee will increase its holdings of Treasury securities by at least $500 billion and its holdings of agency mortgage-backed securities by at least $200 billion.

Two interesting notes here. First, as I was listening to the phone conference that JPo held in lieu of an in-person meeting tomorrow, his message was essentially “okay, we’ve done literally everything we can, so the onus is now on Congress to get some fiscal stimulus ready.” He knows that Treasury purchases aren’t going to effectively transmit capital to where it’s needed in the “real” economy - small businesses and individuals who can’t go to work.

Now, you asked about households. It's true we don't have the tools to reach individuals and particularly small businesses, and other businesses, and people who may be out of work, or whose businesses may experience a period of very low activity. We don't have those tools.

- JPo

Maybe more interesting, he emphasized numerous times that the Fed is not looking to go to negative rates, and is not seeking additional ability in terms of the kinds of assets that it can purchase.

You know, we looked at negative policy rates during the global financial crisis. We monitored the use in other jurisdictions. We continue to do so, but we do not see negative policy rates as likely to be an appropriate policy response here in the United States.

[…]

We don't have the legal authority to buy other securities other than the ones we already buy. And we're not seeking authority to do so. We haven't discussed that at the FOMC. And it's not legal authority that we're seeking.

- JPo

One of the measures I’ve long thought that the Fed would eventually have to resort to is loading up on bad corporate debt and basically anything that pensions own which is getting significantly marked down. It sounds like JPo doesn’t have much interest in doing that, but let’s see how things develop.

The bottom line of all this is that the Fed has shot its shot and markets are waiting on fiscal. My estimation of the likelihood of that happening in a way that convinces markets for more than a few seconds that things are going to get better is not good.

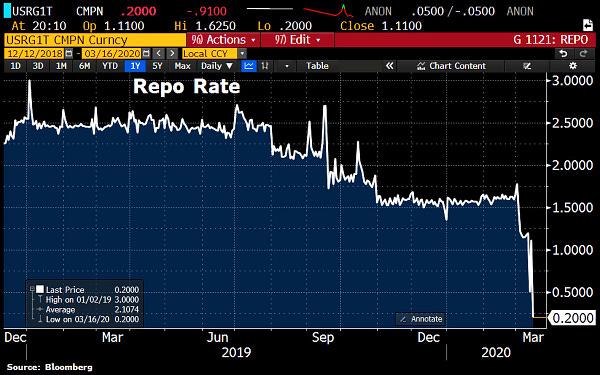

Based on the lowish utilization of last week’s $1.5T in repo, I think the Fed knows that the glut of QE they’re about to do isn’t necessarily a game-changer for primary dealers (big banks), but I think this is a move to get ready to accommodate the purchase of heightened Treasury issuance for a huge fiscal deal to be announced from congress.

(Error in my tweet - that should be '“$500B of headroom.”)

In any case, the market response to the Fed’s bazooka was lukewarm to say the least. Yesterday was historic with the S&P getting slammed down 12%.

I remain almost religiously short everything for the next few weeks as the real economy continues to crumble and policymakers prove unable to keep the wheels on the wagon.

If you weren’t already horrified at our economic prospects, check out this (unverified?) summary of a Goldman Sachs client update call.

Trading

I’ve got a fellow Bearhaus lieutenant with me here in Ohio and we spent a good chunk of yesterday debating how to play this going forward.

Since I last wrote, I’ve taken profits on maybe 30% of my options allocations. I closed out my Mar’20 303/310 strangle at a good profit.

The Dec’20 Eurodollar futures I was holding also hit my mid-term price target of 99.7 after the Fed pump. Sadly I made a classic mistake, got greedy, and didn’t let them go until the next morning when they came down to 99.63. Still a good trade.

It’s hard to justify buying options now with volatility so high. I priced out another strangle because I wanted to continue betting on vol, but the moves necessary to make it work in the market are truly huge.

So, like an absolute moron, my only recourse is to continue naked shorts of /MES (S&P futures). Because I am so pigheadishly confident that we are in for absolutely massive downside in almost every major asset market (maybe bonds excluded) I’m going to try maintaining this position for a few days, tempting though it may be to take profits.

It’s a long way down from here. Cash is king.

Be cool, honeybunny.

Where do you see HYG go from here and in what time horizon?