Hi. I’m going to take a run through my recent trades, how my PNL’s doing, and then move onto a scatterbrained analysis of the last few days in the market and where I think we’re headed.

If you’re not interested in the trading stuff and only want to hear about macro, move on down to “Analysis.”

As a reminder, nothing here is advice. I’m essentially a neanderthal with an Interactive Brokers account and a subscription to RealVision, so you’ll probably lose money imitating me.

How did last week end up?

Macro analysis isn’t as meaningful if you don’t have skin in the game, and watching someone blow up their account (one way or the other) is fun, so here we are.

Futures shorting

I got an unexpected dividend of mercy from the market gods when on Friday, pre-liftoff, my subconscious rudely awakened to tell me that it was time to close the /MES (S&P 500 futures) shorts. I covered the tactical shorts at various places around 2450 and then finally closed down the entire position around 2558 at about $9k worth of profit. I guess my rationale was that the market felt exhausted and after a 9% down day, well, mean reversion is still sort of a thing.

Shortly after, concurrent with Trump’s speech, the market rocketed to nearly 2700. This wouldn’t have blown me out if I hadn’t covered, but it would’ve erased a lot of gain and probably put me in an uncomfortable spot.

This is why trading futures is stupid. I got lucky and out in time based on a combination of animal instinct and phone proximity.

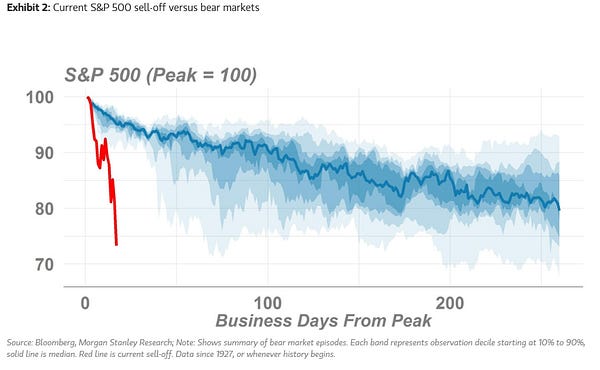

That said, I still think we’re in a secular downtrend and so will be putting on small shorts as my idiot lizard-brain tells me to.

All other positions

I added 3 SPY Jun’20 puts @ 220 - still have strong conviction that we’re headed into a particularly nasty bear market and that will be written on the wall by sometime in May.

Otherwise, everything is doing fine. The short options positions obviously gave some back during the pump to 2700, but they’re still net green.

Ditto with the eurodollar futures (GE Dec14’20), though I’m not entirely sure why they’re falling in price slightly. As far as I can see, it’s more likely than ever monetary policy is going to ease significantly. I wouldn’t be surprised if the Fed comes out with a deep cut to 0 (or near) in the next few days, so I’m not sure what the eurodollar market is telling me here. I continue to remain very bullish on that position with a target upwards of 99.7 as central banks around the world continue to frantically douse the virus in liquidity.

Performance

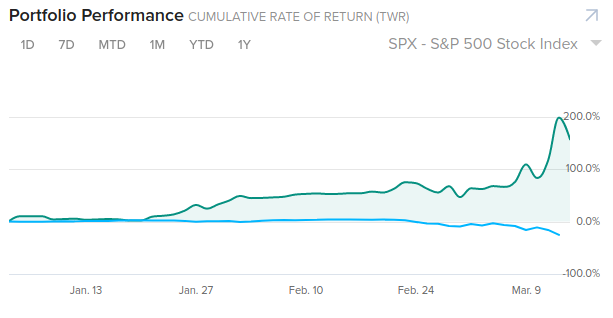

YTD so far is pretty good (started actively trading again in mid Jan), so let’s see if I can keep it up.

Blue is S&P, green is me

1Y is the more interesting look. I’m finally beating the S&P cumulatively after being significantly down due to my eurodollar panicsale last year. Maybe sometime I’ll describe that episode in detail if there’s any interest.

I’m net at about 16% return and the S&P is at -11.7%.

Analysis

I’m recoiling at the thought of even trying to sum this week up.

This market’s falling faster than ever before and I think the proximate causes are obvious:

leverage,

the promise of a prolonged, galaxybrain-level negative shock to consumer demand, and

deep trouble in the credit markets.

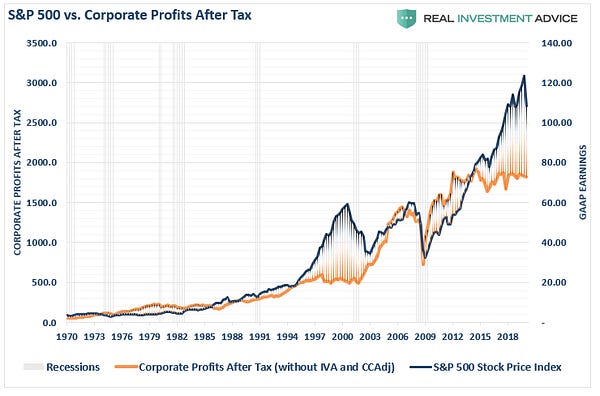

Review the divergence between corp. profits and stock price a second time. I’ll wait.

Restaurant owners in major cities are literally unable to pay rent given what look to me like record declines in business.

Restaurant reservations are down 52% YoY in NYC. And that may not be anything unprecedented other than the fact that it’s happening to varying degrees in every other major city in the country. And for an indeterminate amount of time.

The restaurant industry in itself may not be a huge deal, but it’s symptomatic of a larger condition. And at what point does that end? At what point are people going to be comfortable resuming public life (and spending habits)?

For a more comprehensive preview of the bad times to come in consumer spending, give this Bloomberg article a read.

Government response - will the market rip on stimulus?

I’m not holding my breath on fiscal stimulus (i.e. congress lighting up deficits to put money in peoples’ pockets) because

it probably won’t be big enough to make a difference, and

it will probably take too long to get both sides of the aisle on board to pass anything.

Let’s say that somehow a bill does get through. Distribution efficacy is not exactly the government’s strong point.

Of course I could be wrong here. Conceivably we could get a big hit of fiscal and markets could rip, I’m just willing to take the other side of that.

Figuring out an effective bailout is one hell of a sudoku puzzle, and I’d almost have sympathy for lawmakers if it weren’t for their cohort being almost completely responsible for this mess between covid19 ineptitude and the bacchanal monetary binge of post-GFC.

(more) Fed bazooka incoming

What I expect for next week is an aggressive response from the Fed. I give good odds on them cutting rates to 0 at or before the meeting on the 18th (which is what my eurodollar trade is about) and probably announcing some bonus QE on top of that too.

They’ve already stepped in to announce another $1.5T in term (i.e. longer than overnight) repo and have started buying longer-maturity treasures (we call this “QE”). This is probably with no aim beyond keeping credit markets functioning.

Bitcoin

has been getting battered in the past week.

I felt this coming and sold off a decent chunk of my holdings. I had been feeling that BTC was too big a part of my portfolio anyway, and have been telling people left and right that because BTC has a dramatically binary outcome, holding a small percentage is the right move. Time to take some of my own medicine.

My feeling is that Bitcoin, during this financial crisis, will continue to act as beta on the S&P 500. It will be sold off significantly on moves down (along with similar assets like gold) as the correlation of everything tightens while everyone darts for cash.

Part of me hopes that Bitcoin comes back to life and rips in my face. That’s a definite possibility, but I think the coming downturn in equities is going to shock a lot of people and Bitcoin’s exchange rate will continue to suffer as the market grows intensely fearful.

However, Bitcoin will have its day in the sun:

Deflation or inflation?

Someone recently asked me which is worth worrying about. My answer is of course both.

Right now we’re in the midst of an incredible deflationary shock. The prognosis for consumer spending is Not Good and oil prices are heading for historic lows. I think this is going to lead to problems in the credit, and subsequently equities, markets. Things are going to look downright depressionary for a while as quarantine, hiring freezes, and defaults continue.

However, the government is not going to stand by and let this happen. There will be a massive response, fiscal AND monetary, and that response is likely to be inflationary like you’ve never seen before in America. Well okay, maybe in the 70s.

This will be the time for Bitcoin, gold, and honestly probably the equities market. And probably bonds. And probably everything else. Every asset will see bid as enormous amounts of new money and credit make their way into the market again. We’ll get stagflation: low growth and enormous (asset?) inflation.

How MMT and fiscal play with this remains to be seen, but the one thing I’m confident in is that the Civil Unrest thermometer in this country is going to fucking explode if the stimulus response is solely on the monetary side.

Thanks for reading. The thing to watch for next week is the Fed’s response to what looks like a very ugly market open on Monday. We may get some kind of continuation in the relief rally, but I think we’re headed down from here over the next month or two.