What I want to communicate to you in this letter is the enormous amount of risk involved with being exposed to the equity market right now. Yes, I’ll share my positioning and how I’m trading this crash, but what I want you to walk away with is the understanding that there is much more risk in this market than is commonly understood.

This is not financial advice (of course) but if I had a lot of equity exposure - I don’t - I’d be selling a lot of it for cash. I think this downward move has much farther to go as the implications of prolonged quarantines, consumer deflation, disruptions to trade, and manufacturing troubles from covid19 become evident, and interface with stockpiled corporate leverage in a not-so-nice way.

—

Today the S&P 500 lost about 10% of its value. I don’t think the pain stops here.

I probably don’t need to tell you that before the crash, price-to-earnings equity multiples were wild, surpassed only by 1929 and 2000.

Relative to the mean, the market remains quite expensive, with the [P/E 10] ratio approximately 80% above its arithmetic mean and 95% above its geometric mean.

- Detailed analysis on P/E from March 20, 2020

Meanwhile, corporate debt as a percentage of GDP is the highest it’s been probably since WWII. Corporates are incredibly levered up thanks to the historical anomaly of interest rate suppression that we got out of 2007.

(I know you’ve seen this chart from me a lot - maybe it’s the last time it’ll come out.)

The market was in a precarious place on a fundamentals basis before covid19 hit. Now that there’s been an exogenous and profound shock to the real economy, the leverage is going to bring us down farther and faster than most realize.

I expect the S&P 500 to lose approximately two-thirds of its value over the completion of this cycle. My impression is that future generations will look back on this moment and say “… and this is where they completely lost their minds.”

- Noted smartguy John Hussman

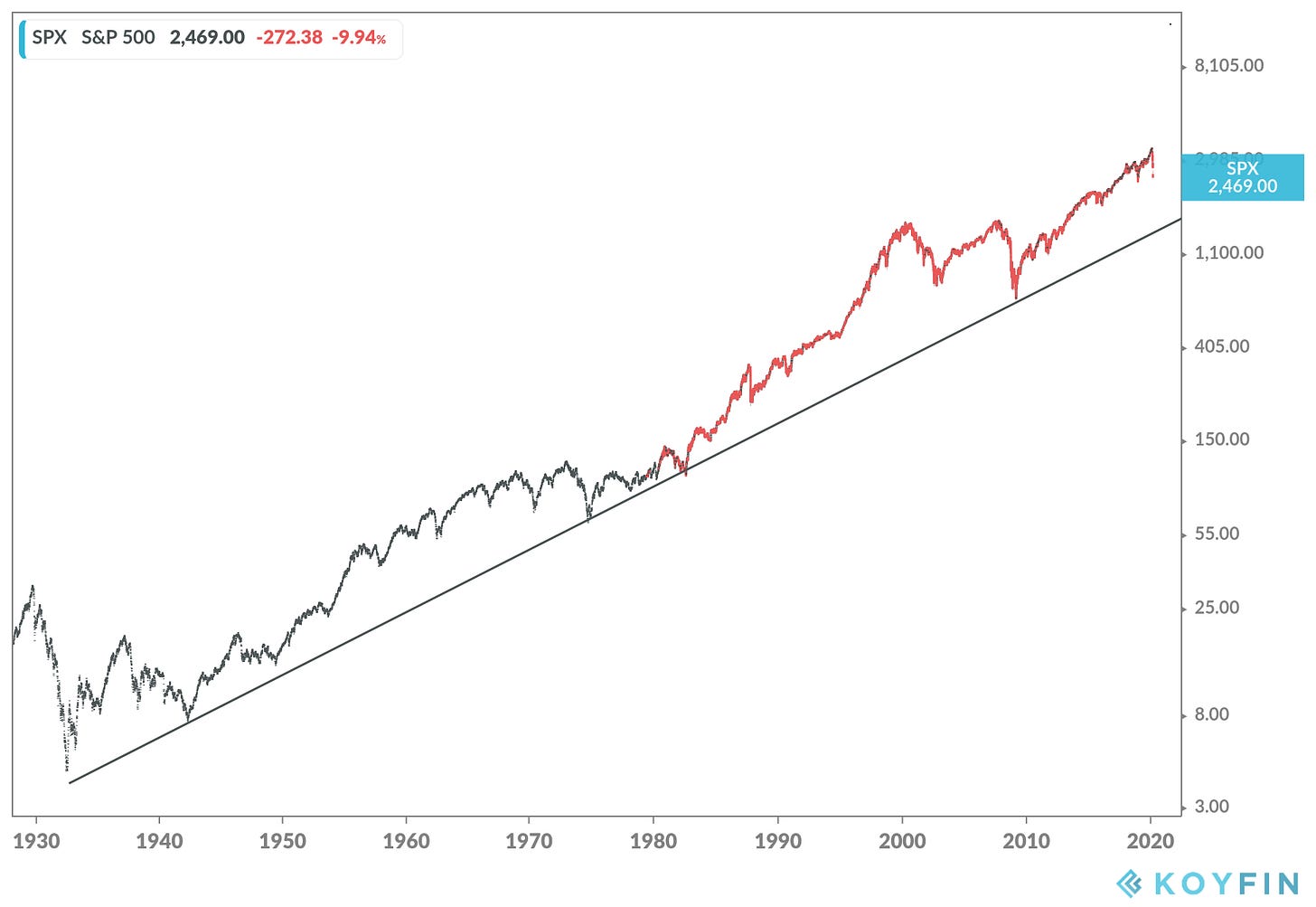

Here’s a somewhat shoddy trendline. You may think technical analysis (TA) is mumbo-jumbo. I mostly do too. But isn’t it interesting that the line happens to intersect pretty well with the major economic cataclysms we’ve had over the last 100 years: 1929 (Great Depression), WWII, the stagflation of the ‘70s, and finally the Great Financial Crisis of 2007/8.

Not unreasonable to model out the possibility that this is a significant trend line and that regressing to it is a possibility. What would that look like?

Zooming in…

That’s a 45% drop. From here.

Now it’s debatable if a trendline gives us a good basis for expectation. But my priors tell me that the unprecedented post-GFC monetary experimentation we set out on (e.g., a 0% target on short-term interest rates for years) have shoved a lot of the fallout and volatility from that event under the rug. It’s only a matter of time before the malinvestment and financialization that have been marinating since come calling.

The deflationary shock that the covid thing poses is real. What business can realistically project cashflows a month out from now? Schools are shutting down, the NBA has canceled its season, Broadway is closed, airlines are knackered - and these are just the relatively mild and obvious first-order effects.

And by the way, this is all before OPEC went defunct, signing a death warrant on US-based shale.

You think there’s any chance that highly-leveraged corporates will be able to whether this storm intact without an extraordinary, unprecedented bailout?

Whatever bailout is needed won’t come in time. I think this is the end of our experiment with volatility suppression via low rates and leverage. I think we’re going down from here, whether it’s 30% or 45%, and I intend to make money while it happens.

Okay, what are the trades though?

Again, these aren’t given as a recommendation. Some of this is dangerous stuff, though some of it I’m surprised more non-trading minded people aren’t doing, like offsetting large positions in equity with out-of-the-money put options.

Shorting S&P futures

Under most circumstances, this one is an idiotic way to trade. I’m using Interactive Brokers to trade (short) the “Micro E-mini S&P 500” futures. In a nutshell, this is a leveraged way of speculating on the S&P index nearly around the clock.

This is mostly idiotic because futures are an easy way to overposition and get your face ripped off with leverage, which happened last year when I lost $46k (let’s call it tuition) trading Eurodollar futures (more on that later).

But since there’s a secular downtrend (covid19) and I’ve learned how to position (read: smaller than you think) and risk-manage, it’s been the most profitable trade in the last week. Largely because the market has gone straight down.

I have a long-term short position that I expect to hold for a few days, about 8 contracts, and a few marginal contracts that I use for tactical trading - selling rallies and covering on dips (with varying degrees of success).

Futures trading, or any trading with leverage, is very tricky and I only got a good sense of it by (as I said) losing money trading eurodollar and Bitcoin futures. If you’re going to play with futures (don’t), always be sure to model out your margin requirements: how much of a point-move buffer do you have before you get margin called? It’s not always easy to figure that out, but you need to have at least a sense of it.

I wouldn’t really recommend this to anyone, but I want leveraged downward exposure to equities and this is one way to get it. The other is…

Buying SPY puts

SPY, as you probably know, is an index that models the S&P 500. You can buy options contracts on it. So buying puts at various strike prices is a good way to make a directional bet on equities while knowing your downside which is an important distinction from futures. When you sell short a futures contract, your downside is unlimited - the market could rip and bankrupt you.

With an option, you’re paying a premium and so your downside is limited but you’re still leveraged. Options contracts typically correspond to 100 underlying shares.

I have a few at various expiry and strike prices:

Jun30 ‘20 @ 265

Apr24 ‘20 @ 245

Strangle: Mar30 ‘20 303/310

The strangle is an options pattern that allows you to make a direction-independent bet on volatility - look it up. I put it on after the first big down move back in early March and I wasn’t sure which direction the market was going, but I knew it was going somewhere in a big way.

I was convinced that early and aggressive action by the Fed might boost the market to new highs, but when the implications of coronavirus hit home with me (along with the lukewarm response to a surprise 50bps rate cut from the Fed) it became clear we were in a bear market.

Puts on HYG

I also bought puts on the high-yield bond index, HYG. These things are poised to blow up - corporate bonds are the analogue to mortgage backed securities for this cycle. They’re being sliced and diced into collateralized debt obligations (CLOs) just like MBSs were and bought by pensions absolutely desperate for yield. A downturn like this is going to blow the default rate out the door and tank this thing.

I bought Aug21 ‘20 @ 80 puts (back when they were out of the money) and I’m hanging onto them.

Eurodollar futures

I don’t have time to explain this one - maybe in future updates - but it has been an incredible trade over the last month. It’s a shame I’ve spent so much preamble because there’s a lot of substance behind explaining this unfamiliar market and the rationale for the trade. Listen to this (excellent) conversation with Raoul Pal for a full explanation:

In short, it allows me to speculate that short-term interest rates are going down, largely thanks to a panicked Fed response to the crisis. My target price is 99.7; as I type this, they’re at 99.640.

—

That’s how I’m trading, but it’s worth noting that I do not own any equities outside of my retirement account (which is itself pretty small).

If I did, I would sell a significant chunk of them now. This market has a LOT of room to go down.

This update was kind of long and overly mechanistic on the trading stuff (and repetitive to readers who’ve been with me from the beginning) - in the future these will be more targeted and nuanced, and frankly more about macro. But the message I want to impart is:

Manage risk! This “buy the dip” bullshit retail has been sold is based on financial history *before* avant garde monetary policy and the rise of passive. Markets can go down and stay down for a long time.

Inflation adjusted S&P permanent break-even chart by Dave Collum in the Investing section of his must-read 2018 Year in Review.

Before you start playing with options and futures, make sure you ask yourself how you’ll feel if your mostly-equities portfolio halves and then stays there for a while.

The potential outcome of this covid situation, the real economy limping along for months while we hid in our homes, is something none of us have ever seen before. Prepare accordingly.

—

If you’re interested in this narrative and want more, I recommend consuming the following:

Is Recession Coming? - Raoul Pal. A great macro overview of the troubling fundamentals before coronavirus was on the map.

This Is Water - Ben Hunt. An essay on the financialization of the economy thanks to unnaturally low rates.

The most realistic assessment of covid19 outcomes I’ve heard from Erik Townsend at MarcoVoices.

Enjoyed this? Consider subscribing.